Today we will be discussing money, along with its properties, functions, and lifecycle in our modern system. This episode is intended to help folks obtain a brief, but detailed understanding how money works and therefore the reason for the development and sudden rise of cryptocurrency and blockchain technology.

Okay, so what’s money?

According to the Oxford dictionary, money is “a current medium of exchange in the form of coins, banknotes” or “assets, property, and resources owned by someone or something,” in other words, currency. Wonderful, but what does that mean? It’s not like assets were suddenly just apparent to everyone, right? People value things for different reasons, so how did everyone on the planet come to agree about gold, silver, the dollar, rubel, pound, etc? As it turns out, money has a variety of both properties and functions that reveal the most valuable currencies as human beings exchange currencies over time. It took THOUSANDS of years for gold to become this standard currency.

The properties of money are both physical and economic including: scarcity, divisibility, portability, durability, acceptability, fungibility, established history, and censorship resistance. These properties allow money to function as money. There are plenty of instances throughout history where if one of these categories is compromised, it reduces the overall value of the money, thus making those examples of “soft money.”

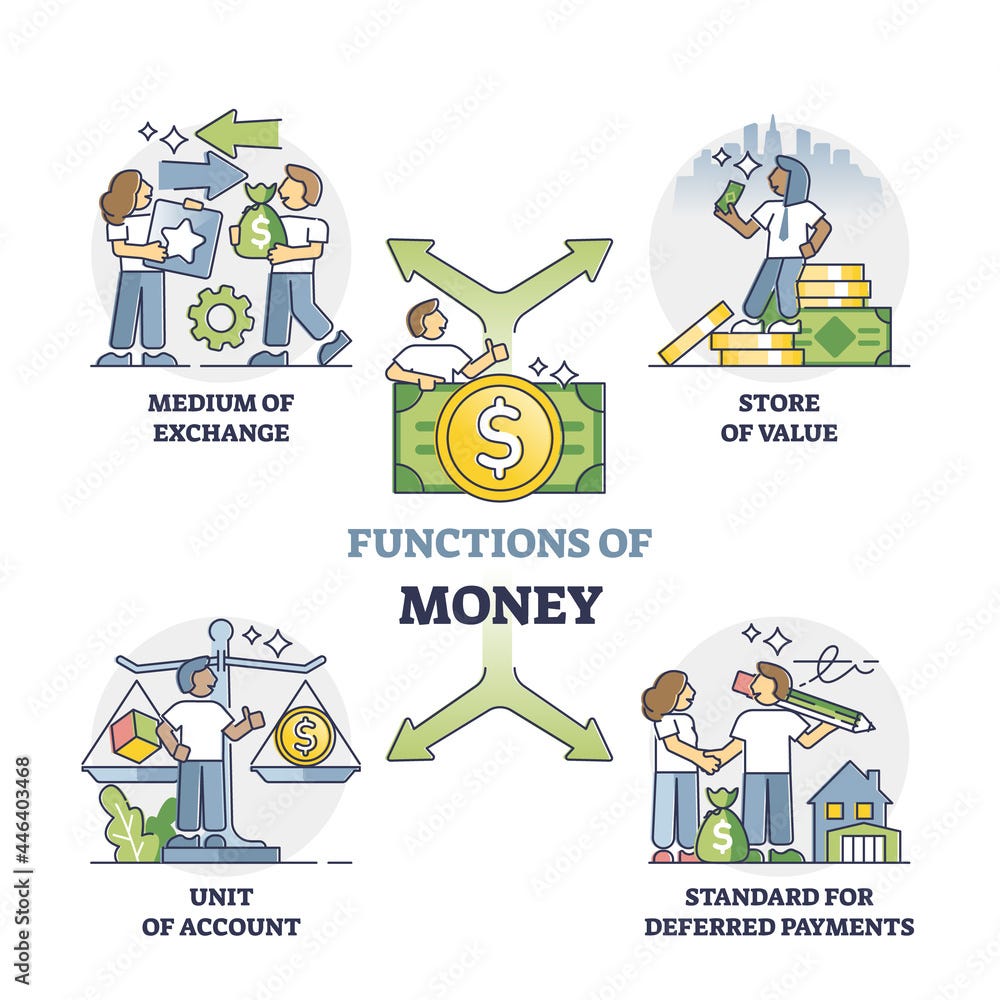

The functions of money are a store of value, medium of exchange, unit of account, and standard of payment. These functions first begin through the collection of the money in question. Once a sufficient amount of a particular item has been collected by the populace, the item begins to store value. It’s only after the monetary item has stored sufficient value that it is then utilized as a medium of exchange. From there, it will become a standard of account at the various institutions that trade it for products or services and BOOM, it becomes a standard of payment. So the function of money can be thought of as an actual mathematical function you might see on a graph as money moves through time and these functions are phased one after the other in a coherent, organized fashion.

A great example of this in practice is Pokémon cards. Pokémon cards became valuable later because only a scarce supply was produced, which people collected over time. Some of these cards were rarer than others, and thus more valuable. If you tried to sell your Pokémon cards within a few days of buying them, its likely few people would value them beyond what they were selling for at the time. It was only after years of deflationary pressure on Pokémon cards through their destruction, that the Pokémon cards became SO SCARCE among collectors that people would be willing to pay big money for the rarest cards, like Logan Paul did last year when he got tricked into buying a counterfeit Pikachu Illustrator card.

Beenie babies, autographs of famous celebrities, artwork, Pokémon cards, these things have value because they are collectible and scarce which helps to drive the “store of value” function of money. Now could any of these examples be a medium of exchange? No, because NOT EVERYONE agrees that Pokémon cards are valuable everywhere by all people. So, it takes a LONG TIME for money to move from collectible, to store of value, to medium of exchange. For gold, it took approximately four THOUSAND years before gold became a medium of exchange around 550-700 BC. The long tail of this monetary development process indicates that various cryptocurrencies and their associated blockchains are very early in this overall process. However, with technology, the development process of bitcoin will likely be lightyears ahead of gold, suggesting that although it is still early, before long, it could also be too late. Though bitcoin is recognized by some nation-states as an accepted form of exchange, it is not a global medium of exchange yet. But WHY bitcoin and not say Ethereum or some other currency? Well, because of all the crypto currencies that exist to date, bitcoin was the first and the hardest of currencies to emerge as measured by the 6 properties of money. This DOES NOT MEAN that cryptocurrencies like Ethereum have no value, that is NOT true. Ethereum operates for a different use case than bitcoin, and it’s not hard currency. It’s likely to become a decentralized financial tool much like any other financial tool. Remember, these cryptocurrencies are all about USE CASES and right now, I am only talking explicitly about bitcoin as it is the only currency referred to as “digital gold.”

And there we have it, the six properties and four functions of money. I appreciate everyone taking the time to tune in this week. Thank you so much for being here to learn about the Convergence of Money and Development.

Money and Development