We often hear these terms “blockchain technology” and “cryptocurrency” used in the same conversation but have only an abstract idea of the difference between the two. This video/article is going to discuss the convergence of privacy and the internet through an analysis of the history of blockchain technological development, consensus/governance, security, and tokenomics.

Online Privacy

One of the earliest known attempts at creating a blockchain-like system was by David Chaum, who developed the "Blind Signature" concept in 1982. Chaum’s project, “eCash” was conceptualized in a two-page white paper where he used the analogy of carbon paper to explain the overall use case for a digital blind signature. [get pics]

Chaum’s white paper outlines the value of this technology using voting privacy for an example. How timely! Say we are in the 1800s and we only have guns and a monopoly on violence to ensure the validity of our promises to each other. How do you ensure the security of the mainstay of democracy, that is the secret ballot? Well, in 1806, the solution was carbon paper. RedBlockBlue does a great job of illustrating the concept as anyone who is under the age of 40 is probably wondering what the hell carbon paper even is. You can find the full video in the description below.

This is the lifecycle of an archaic, 1800s private signature voting mechanism. You take your paper that you write your vote on and enclose it in a carbon envelope with your address or (public key) on it. It then goes to a trustee or a verifier who goes “yup, that’s a real address on this network” and signs it WITHOUT ever opening the envelope to reveal its contents. In the case of carbon voting, once you open the carbon envelope upon its return, you can see the trustee’s signature is on the voting paper. Now the voting paper can be mailed straight away as both secret and valid because it has the trustee signature verifying the address and the anonymous vote. This process separates the responsibility of “knowing your customer” away from businesses, and reconstitutes this authority back to the users, or voters themselves.

This innovation, along with other innovations like the creation of the decentralized ledger by Stuart Haber and W. Scott Stornetta in 1991; the first convergence of these concepts in the 1993 “Digital Cash” system by David Chaum, Amos Fiat, and Moni Naor; and the invention of Adam Back’s Proof of Work system in 1997 are all what make both blockchain technology and cryptocurrency ecosystems possible as they each drive the governance, security, and tokenomics variables on each chain, thus deriving the underlying value of the currencies attached to them. What Bitcoin is and what the blockchain is, are a culmination of these inventions spanning from 1982-1997. It wasn’t until 2009 that one person, or persons, Satoshi Nakamoto released Bitcoin. After Bitcoin was released, many others followed. In the same way not, every country has the same culture, neither does every blockchain. Developers therefore have continued to innovate new governing structures, or consensus mechanisms in this space, resulting in a variety of new ecosystems all the time.

Governance/Consensus

Let’s refer to the trustee from our example – this trustee is the “node” helping to verify transactions on the network. But because it doesn’t take special knowledge to go “yup, you sure do have 5 dollars in that account to purchase this coffee,” and we don’t need to pay people exorbitantly to do so, either these nodes can belong to ANYONE and EVERYONE. Why does that matter? Well, because we can’t have ONE trustee signing everything, right? That would be a dictatorship or some kind of authoritarian regime, we don’t want that. Tons and tons of dictators have added debts to their citizens after receiving large sums of “assistance” from the World Bank and making off with those funds, leaving citizens to carry on the debt into the lives of their grandchildren. Having several central banks run the global ledger while taking a slice of every transaction, charging interest, and never forgiving debt, is an aristocratic or oligarchical money structure. We don’t want this either. Before 2009, there hasn’t been even an option for a better system in all of human history. The last “innovation” we had was the central bank in the 1600s which began BECAUSE of a bank failure.

Therefore, instead of casting a vote with our dollar in an oligarchic or aristocratic monetary structure, we have an opportunity to democratize that power on the blockchain. This democratizing power comes in the form of becoming our own banks, collectively balancing our own check books, validating transactions on the blockchain for all, so long as we all agree that the program we are running is the best one available. How do we know which one is the best? Well, we look to see which program each node is running and whether they will “flag” to change to the proposed “better” solution, later. Therefore, we have to go where the action is, where the transaction is being validated.

Validating a transaction consists of making sure both addresses listed in the transaction have the funds necessary to facilitate it (as listed on the blockchain public & digital ledger). Additionally, a miner, or validator confirms that the transaction isn’t underway elsewhere on the network (double-spend problem). The transaction is then thrown into a pile referred to as a “block” and once the last transaction is verified, that validator has “mined” that block (Proof of Work), by providing the “number once used” or “nonce” that occurs as the last transaction is confirmed. The “under the hood” process of this computerized environment is “the blockchain.” Much like how the internet is just “there” everywhere we have electricity, the blockchain is also “there” everywhere we have internet or data. This means that your funds can’t ever be inflated, seized, frozen, stolen, or otherwise manipulated (at least on Bitcoin to date) when used appropriately.

THIS IS WHERE A LOT OF PEOPLE GET CAUGHT UP

I often hear “but you can just change the program” Bitcoin isn’t backed by anything.” I mean, sure, can you just change the program and write something else? Definitely. But that doesn’t mean everyone will find the new program valuable. Take your local Word Processing program, would you rather use Word, Google Docs, or Notes? They are “all the same” but they are also not “all the same.” Two are substantially better than the third and those two have different use cases and value points based on those use cases. Like any other software, the blockchain IS CODE. But it’s the processes and behavior associated with that code that gravitates users toward it, thus indicating which is more valuable. Once we understand WHY something is valuable, we then value it. That is part of what Crypto Convergence aims to do – communicate the value of these systems to you so you don’t lose out on the use case long-term.

Not every currency matches every blockchain, but most of them do for continuity. This means that sometimes discussions surround the underlying asset (the currency or token) while in others might be about the protocol (or blockchain) under consideration. Either way, one does drive the value of the other, so keep that in mind. This concept is why it’s so important for you to DYOR when interacting at the base layer of a blockchain as its necessary to understand the rules of the game and the gaming environment you are playing in. If you’re on Coinbase, Robinhood, etc., you’re on a “layer 2,” environment and therefore, you have largely decided on the aristocratic governing method in exchange for speed, access, and fraud prevention is cool with you. This is TOTALLY FINE. Don’t let anyone shame you for how you play your crypto game.

The democratization of financial decision-making tools is important to consider. Anyone who has tried to take money out of an ATM knows, even if you have money in your account, the banks limit how much control you have over your funds; how you move your funds, to whom you move your funds, when, etc. For some citizens in the world with unstable governance, civil unrest, or terrorism, this financial democratization is likely the most important item on the list when thinking about securing local families. Banks can FREEZE accounts, making families destitute with the click of a button. By depositing hard-earned money with them, depositors are implicitly entrusting their livelihoods to centralized authorities who may change policy, tactics, or stance at any time and without the consent of depositors due to emergency, war, disease, or disaster, exactly when you need your funds the most. However, we often forget that bank deposits are bank liabilities, assets. Imagine yourself going to a summer event at your local park. If instead of a ticket, you were required to produce and leave your wallet and its contents to the folks at the foldable table entrance, would you do it? Don’t expect a bank to, especially in times of crisis.

We put our money into banks. We put our pictures in the cloud. We put our money on the blockchain. Whether it’s our precious memories, personal data, or money, human beings store value. When we store value, we should always be looking for the hardest to manipulate money, in the most secure environment possible. If google or apple ever go out of business or their servers go down, there go all your digital valuables. The blockchain is simply a hardened version of the cloud that is secured by everyone all at once who use it, not by the company’s server providing the service from a centralized location. The second someone tries to do something crazy, or take funds on the blockchain, other computers recognize the behavior and actively ignore the bad actor, just like a good democracy does. In this world, so long as you have your “account pin” or in the case of crypto wallets, your “12-word seed phrase,” you will always have your valuables because they aren’t held on a single server at google, they are on the devices across the GLOBE already connected to the internet.

From a purely technical standpoint, for a user to lose their bitcoin, assuming no action on the part of the user, nearly the entire cohort of bitcoiners, which is approximately 19,280 reachable nodes across 94 countries, amounting to approximately 80 million users worldwide would have to stop using the Bitcoin protocol. With a market cap of $1.2 trillion, I find that highly unlikely. Ethereum, the next most competitive network to Bitcoin, with a totally different use case, has approximately 20 million monthly users, 4,469 reachable nodes across 80 countries with a sizable market cap of $398 billion. This movement isn’t going anywhere, and I doubt highly that 80 countries plus can agree on anything ONE thing at all. These will be here for as long as the internet is here, which is forever.

Cryptocurrency & Tokenomics:

At this point, you’ve already got a sense of what the cryptocurrency part of this equation is. But just in case, let’s run with another example. Cryptocurrency is the reward the miner gets for validating the transaction – it’s kind of like Kohl’s cash, or coupons. You can only use them on the blockchain they are built for (for the most part). Practically, you shop at Kohl’s, buying a new pair of pants and receive Kohl’s cash as a reward to incentivize you to shop at Kohl’s again since they gave you free money to do so. But if you are a Gucci shopper and someone gives you Kohl’s cash, you’re going to give them a weird look. Same thing for Bitcoin or Ethereum. The downside with Kohl’s cash is that Kohl’s is centralized and therefore gets to decide how much Kohl’s cash is available in the supply for shoppers to be awarded (inflationary) and how much Kohl’s cash can be used in each transaction (deflationary), thus controlling the ultimate float of the money in circulation.

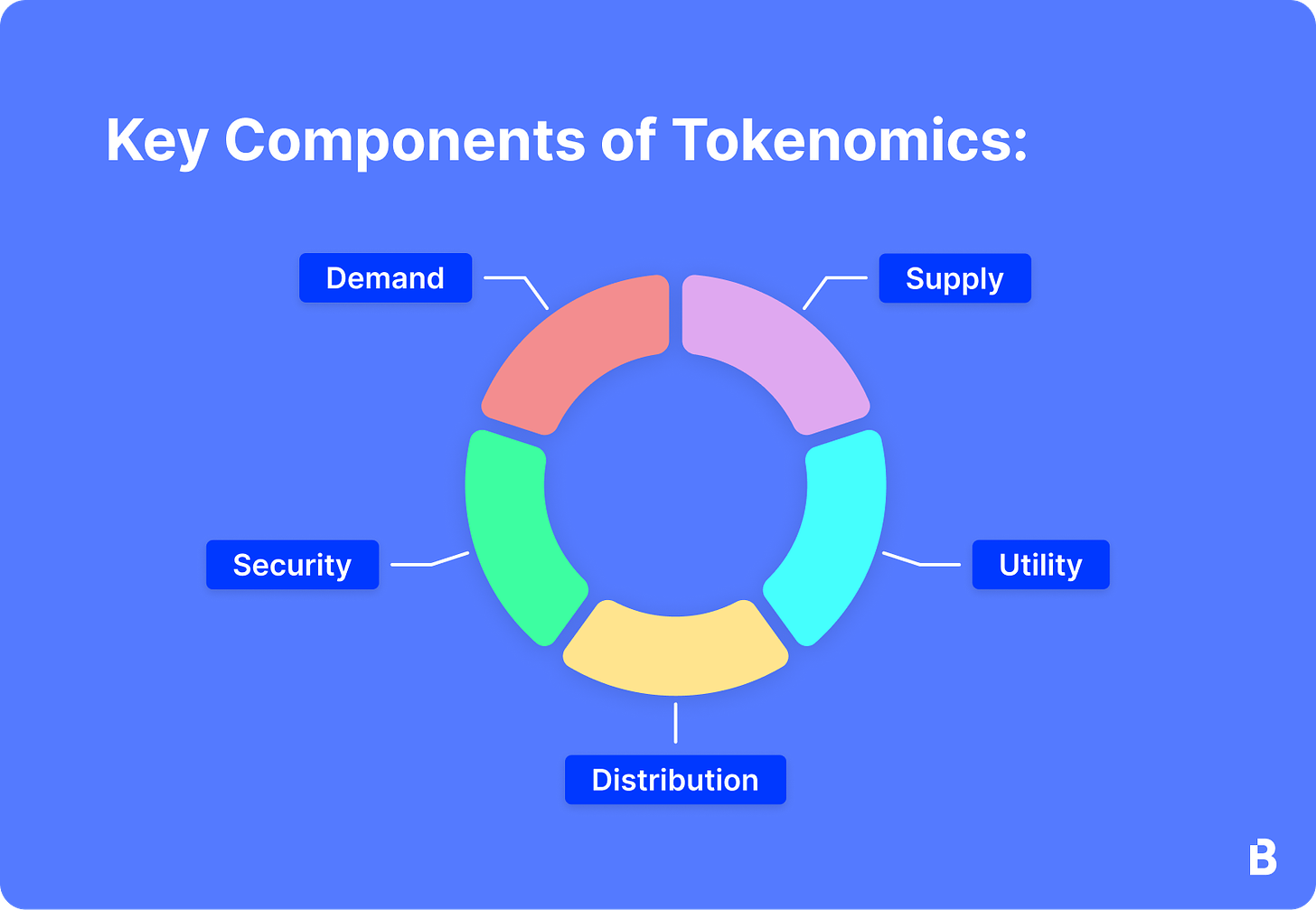

This entire process, how money is created, destroyed, distributed, etc., is referred to as “tokenomics” in the crypto world – it’s the economic architecture of the blockchain ecosystem, the parameters of behavior programmed by the token’s software. Since many blockchains have different use cases, behaviors, and functions, the value of the coins can fluctuate greatly based on the development team working on the blockchain project as the token is kind of like the “stock” of the blockchain where if developers say they want to implement some new rule and the existing nodes do not want to, they may sell off that blockchain’s token as a result. Therefore, the harder that currency or token is to change, the more VALUABLE it is. You got it? This is why bitcoin is often referred to as “digital gold.” In part, its because the bitcoin tokenomics consists of proof of work, a difficulty adjustment overtime, a maximum supply cap, and a variety of token holders besides the Satoshi Nakamoto wallet that have stake in developing the protocol. Each of these characteristics, working in concert, determine the overall viability, vigor, and value of a particular protocol.

As I’m sure you know, there is TONS of room for nuance and you’ll become more comfortable with it as time goes on, like with any new system. The important thing is that you’re here, learning today. If you’d like to learn more about Bitcoin, crypto, blockchain, Ethereum, Web3 and all the rest, I hope to see you for our next episode! TYSM for being here.

Sources:

https://link.springer.com/chapter/10.1007/978-1-4757-0602-4_18

The Convergence of Privacy and the Internet