There’s a lot of talk about how Donald Trump is the “first presidential candidate to accept crypto in 2024,” this statement, per usual by the mainstream media is true, but misleading. Back in the 2020 Presidential election, Andrew Yang was acktually the first candidate to accept crypto currency donations for his campaign. So, in 2024 is Trump the first? Yes. Is he the first EVER, no.

Every reader should think about this small play as we enter the general election season and each of us hear “crypto” with increasing repetition. That said, it would be beneficial to understand the full parameters of these characters, excuse me candidates, that we are forced to deal with because they are as cryptic as they have always been, especially as it relates to crypto.

I would like to begin by first noting that language seems to change throughout debates across the internet, allowing for constant misinterpretation of the “other” camp. To prevent this here, I will detail a bit about how that language is defined. In a comprehensive analysis of the philosophical, technical, and economic indicators of digital assets, “Only the Strong Survive,” by Allen Farrington and Anders Larson, the authors identify a divergence between “money” and “cryptocurrencies.” Farrington and Larsen outline that “a security, and a yield, assumes and requires a separate money,” detailing that “proof-of-stake” algorithms lose the “fight for liquidity,” as “the basis of value grounding has explicitly become ‘yield,’ meaning the token is fighting for liquidity not on the basis of money, but of being a security.” This argument from the authors suggests that essentially all proof-of-stake protocols are likely to be considered securities and thus be prone to regulation from the United States Securities and Exchange Commission (SEC).

Based on the writing presented in the Biden administration’s 2022 Executive Order on Ensuring Responsible Development of Digital Assets and subsequent call with “Senior Administrative Official[s],” it is my contention that Biden broadly agrees with Farrington and Larson’s suggested differences among these two categories. For the Biden administration, “cryptocurrency” and “digital assets [read – money]” are NOT the same and therefore will be treated accordingly. If this hypothesis is true, however, how can we identify which asset is likely to be defined as which?

In his 2022 E.O. President Biden seems to imply that proof-of-work protocols like Bitcoin are more likely to be considered hard money or “digital assets” as a Senior Administration Official notes, “The benefits and risks of digital asset systems are fundamentally dependent on their design and governance,” adding that “Most current digital asset systems were not designed with critical controls in mind like identity, sanctions screening, and revocability of illicit transactions.” This very specific language seems to be targeting the governing structures of various crypto protocols and their reliance on anonymity, a heavy nod at Bitcoin. In the wake of FTX, this E.O. also noted the following:

“Some digital asset trading platforms and service providers have grown rapidly in size and complexity and may not be subject to or in compliance with appropriate regulations or supervision.”

This quote seems to be a reference to proof-of-stake (PoS) protocols like Ethereum which is natorious for the Ethereum 2.0 updates meant to address scalibility and complexity issues on the network. Ethereum and others like it provide the aforementioned “yields” or “interest” associated with SEC regulation that has yet to take place. This is inidicative of the notion that the Biden Administration is likely to target PoS protocols in its regulatory goals while studying Bitcoin or proof-of-work (PoW) protocols to model a U.S. based CBDC, reaching its innovation goals. Lambasting its devotion to these goals the Administration noted, “a core policy objective” of this action “is to maintain the centrality of the dollar in global financial markets and in the global economy.” Therefore, when the Biden Administration is referring to “threats to the U.S. Dollar” this absolutely includes Bitcoin and nothing else. Why nothing else?

All but confirming the Biden Administration’s hawkish disposition, state officials said that “foreign central bank digital currencies [CBDCs] — [] their introduction by themselves do not threaten this dominance [of the U.S. Dollar],” validating that the existing CBDCs are of no concern to the United States in their current configuration as all fiat currencies that a CBDC could peg to are highly undervalued in comparison to the Dollar. In the same briefing these stakeholders suggested that U.S. adversarial powers such as Russia use crypto to circumvent economic sanctions, thereby weakening the United States’ more passive response to the Russian invasion of Ukraine. So, does the U.S. have a vested interest in regulating crypto because nation-states could use it to avoid sanctions or do CBDCs not really matter because all the existing currency is too weak in comparison to the Dollar?

Voters should understand that the Biden Administration is taking a “whole of government approach.” On one side of the government, Biden will work to study Bitcoin to develop a United States based CBDC that will outperform the existing 40 other CBDC to protect the supremacy of the U.S. Dollar. On the other end of the government, the United States is working to actively choke the remaining sectors of crypto that are presently innovating in the DeFi space to ensure its own success against it only real competitor, Bitcoin. At the end of their call, these Senior Administrative Officials said that “this executive order signals the beginning, not the conclusion, of this administration’s work around digital assets. As this ecosystem evolves, so will our approach.”

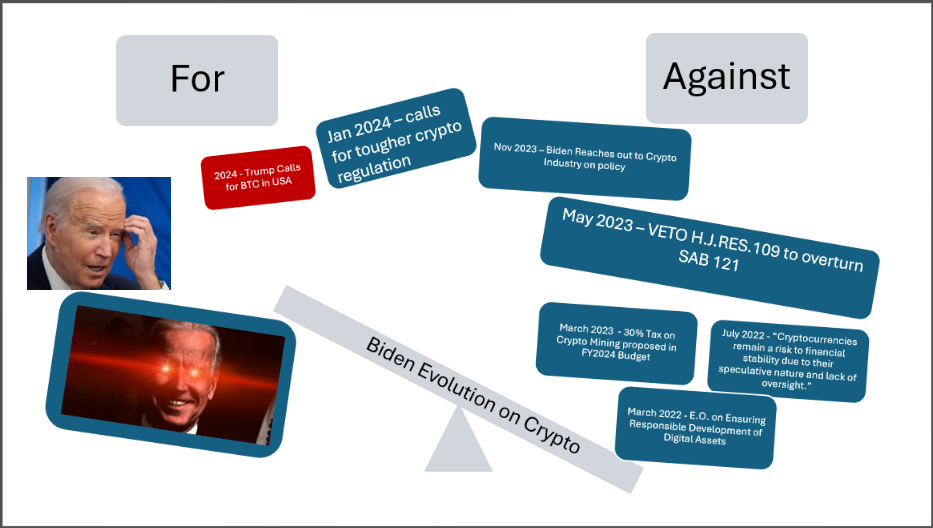

Here is the evolution of the Biden Administration’s Approach to Digital Assets:

What can this mean for the everyday person though? It’s not like I use the Bitcoin ATM or pay for anything with crypto. Why should you care so long as the U.S. “wins,” right? My concern lies with what the Biden Administration has termed “micro-risk,” which is apparently “the risk to each individual consumer, investor, and business that engages with these assets.” Previously, I was under the impression that government has the authority to intervene in such financial matters under a narrowly tailored government interest. From what I can see, “protection from digital transactions” is not at all a narrowly tailored exception that would merit this type of broad intervention in our financial lives.

Does a President actually get to decide what risk you’re allowed to take for yourself or your business? If it does, then do you really need the “name brand” or can you take this generic government version instead? If it doesn’t, then do you want President Biden to decide what the definition of a “micro-risk” is, especially after the instantiation of the wildly successful “micro-aggression?” Later in the call on this E.O in 2022, the administration pretended it had no idea how the current financial system even necessitated the creation of digital assets.

Joe Biden is telling the American public it has no idea how the financial system is failing consumers and then telling voters in the same breathe what risk is allowable according to government defined terms. Why is all of this happening? Why is this so pervasive? Well, a long time ago, governments figured out how to supply a war effort from your savings account without ever having to raise taxes. This type of willful ignorance from the Biden Administration is exactly the type of dangerous “politicking” that voters need to be aware of when seeking to cast their ballot. While discussing the future of the global financial system the Biden administration had this to say:

“[The E.O.] recognizes that our assessments of the risks and potential benefits of digital assets must include an understanding of how our financial system does and does not meet the current needs of consumers in a manner that is equitable, inclusive, and efficient.”

To add insult to injury, these same officials noted the following:

“The primacy of the dollar — the U.S. dollar — it’s underpinned by fundamental advantages that the United States has held for a long time and continues to hold credible and longstanding commitments to transparency, our rule of law, the contractual obligations and rights that everyone enjoys, the deepest and most liquid financial markets in the world, sound economic governance, and the full independence of our Federal Reserve system. So those are the institutional features, the competitive advantages that give the dollar its primacy.”

From these statements, it appears that the Biden Administration would like the populace and the world to forget how the U.S. Dollar (and every currency before it) became a reserve currency in the first place as if our institutions were simply so robust that they were better than the Gold Standard purely on merits. Recall the truth, advances in telecommunication largely drove our ultimate departure from the Gold Standard as gold was increasingly unable to underpin the modern financial world. As such, gold is therefore the “money” while the U.S. Dollar is the “currency” operating transactions as the “layer 2” settlement option (to put things loosely). U.S. institutions are not “money” in their own right – we all know that. Right?

It is in the proof-of-stake protocols on Ethereum and perhaps Ethereum itself whose “rug pulls” will likely be the examples that are used to justify the Biden Administration’s intervention in the will of the retail investor while pretending it is completely unaware of the depreciation of the Dollar by our institutions inflating the currency and not global dominance of the Dollar through robust American institutions. Joe Biden believes that these technologies are too complex for you to understand. I say the financial shell game is over and you’re smarter than he pretends you are. His cohort stated as much in 2022:

“I think that just the very fact that they [digital assets] are digital does not, you know, magically solve these problems.”

Is this a joke? Are they intentionally being obtuse? Or is this another scene from The Shawshank Redemption that is our financial lives? I’m kidding. But really, back in 2016, I recall watching that Zuckerberg Congressional hearing, you remember the one, about Wi-Fi. You’re telling me these people can draft, debate, and execute complex legislation, use social media to promote it, enter insane trading positions as a result of their work, and they don’t know what this technology is, what it does, why its better than TradFi or how TradFi fails? Come on, now. Let’s be real.

To be clear, the crypto industry is new and there are a variety of scams that can be difficult to identify to the common crypto user on Robinhood or Coinbase, but that does not mean that this technology or the opportunities it presents are an inherent risk or threat to anything other than the status-quo. For this administration, to simply identify the central axioms of why this technology was created takes a taxpayer funded study to decipher. Is this the administration you really want to decide your financial future?

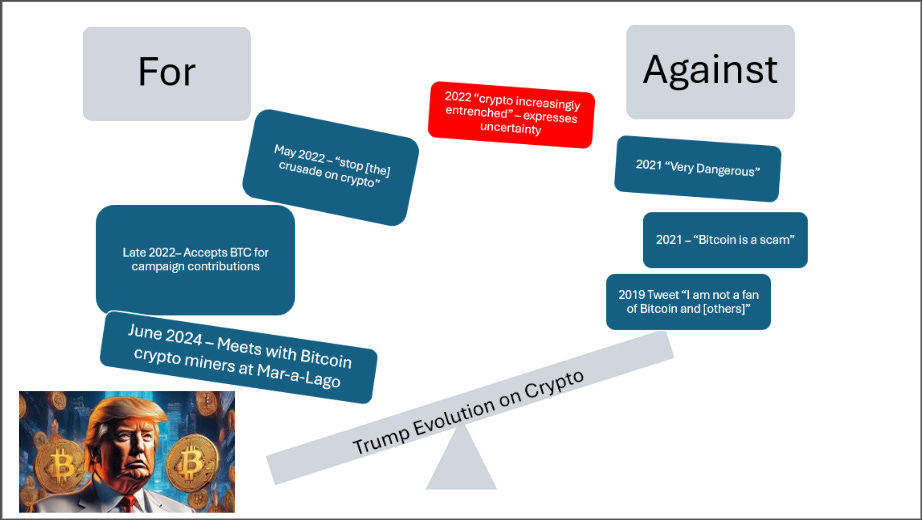

What’s the other option? Oh yeah, Trump. Of course. How could I forget? Ironically, Trump has a more direct line to crypto from worrying of its dangers back in 2019, to publicly questioning whether his opinion was correct in 2022, to outright acceptance and a 180 on his crypto position by May 2022. Is that type of volatile movement on policy any more trustworthy than the Biden Administration? Probably not. But what I do know is that Trump is the only one meeting with crypto miners. Two years ago, while Biden was proposing an FY2024 budget including a 30% tax on Bitcoin miners, Trump was noticing the trends among the American people. By 2024, Trump is meeting with Bitcoin Miners at Mar-a-Lago while Biden is apparently just “reaching out” to industry leaders. When the Biden administration tells us there are already 40 CBDCs in various forms of development, does anyone think it’s a good idea to continue to delay development in the sector? I’ll wait.

In the meantime, here is Trump’s evolution on crypto:

Okay, the picture is just funny, calm down. Looking at this, if you’re a crypto enthusiast, this may not be uniquely surprising to you. For others, this conversation is only just the beginning. Therefore, whether we love or hate them, we must look at both candidates and understand that they both have potential to hurt the industry with the power that will be bestowed on one of them in the fall. What’s important is that you know how they each act today versus what they have done in the past.

**This article is NOT advocacy for either candidate, it is not financial advice, and its most certainly not meant to be some divisive piece of information. This article is to simply remind us where we are in the context of this conversation and the moves that have already taken place on the board with my unique and spicy commentary. Thank you for being here.**

The Elderly and Cryptic