Is FFIE A Fair Trade in FY2024? Maybe.

Caulene MacDonald

Research Analyst

06/07/2024

After 2021, the craze of losses and gains from the GameStop bull run has left investors with some apprehension moving forward in markets. Though we still find institutional whales like Andrew Left making the same mistakes with new enthusiasm, it is unclear if there is truly a divergence in the valuation of these stocks or if something more is happening in the market. Is it possible that hedge fund managers and retails traders are so far apart economically, that the two parties have difficulty assessing value in the same way, creating volatile price action in the short term? As a result of these speculative markets, it has become increasingly difficult to ascertain the potential gains or losses on a variety of investments. One investment opportunity being kicked around by MSM, and retail traders today is boutique manufacturing company, Faraday.

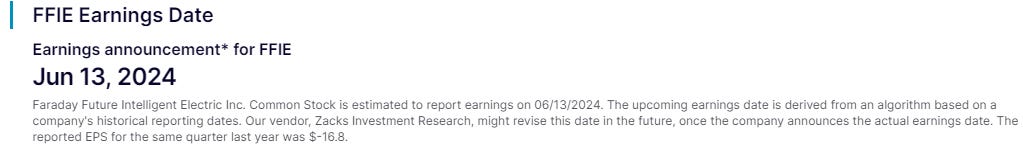

Faraday Future Intelligent Electric (FFIE) is a company that specializes in the manufacture of electric vehicles, founded in 2014 in Gardena, California under CEO Matthias Aydt. FFIE offers a variety of services to its customers including consulting and prototyping services to clients, along with research and development. It was only in 2023 that FFIE published its first profits report as it did not make one in FY2022 and despite that, FY2023 saw FFIE top-out at $117.36 per share.

In an open letter published by Business Wire in February CEO Matthis Aydt, outlined that FFIE plans to leverage a burgeoning strategy to address market difficulties through the progression of a U.S.-China bridge strategy which executives believe will provide a path forward to infiltrate Middle Eastern EV markets. Additionally, Faraday’s premier EV, FF 91 2.0 Futurist Alliance, which launched last year showcasing a multi-axis torque technology system for AI propulsion, steering, and braking. Furthermore, FFIE executed an agreement with the Abu Dhabi Investment Office (ADIO) to support the design, testing, and manufacturing of transportation applications, including EVs within the Smart and Autonomous Vehicles Industries (SAVI) clusters. The hope is that this strategic partnership will greatly reduce the cost of production, thus driving sales. This high-tech AI is so cutting edge, that its use cases are innately structured for those individuals with greater access to capital markets, requiring that FFIE restructure its organization to appropriately leverage existing markets. You can take look at the FF 91 2.0 Futurist Alliance here:

Recently, Faraday has undergone scrutiny for its ambitious goal of developing the “US-China Automotive Industry Bridge Strategy.” Part of this strategy is reverting to its former organization model whereby Faraday formerly followed a two-brand setup to prioritize the sale of its luxury tech items. Therefore, Faraday is making the bold proposal that the U.S. should marry its manufacturing capabilities with China’s supply chain and manufacturing facilities as a method to break into the Middle Eastern EV market. The only real question is whether this firm has the tenacity to pull it off. In their most recent earnings report, FFIE outlined they need additional investment to solve these issues. From the POV of a retail trader, this is valuable in the same way Elon Musk is valuable. He nearly went bankrupt trying to solve the EV problem, only for it to be successful. Does that mean FFIE has a better shot than Tesla did? Who knows. Financially, the picture isn’t pretty.

According to Faraday’s recently filed SEC Form 10-K, revenue year-on-year has remained relatively static, showing only a slight reduction in current liabilities from $328.2M to $302.3M, respectively. Operating expenses have also been a significant financial issue for the firm, resulting in a total net loss of $431.7M in FY2023, down from $602.2M in FY2022. Considering these figures, we can see that debt reduction is picking up in the company as it has opened its second $50M traunche as a hedge against time while FFIE re-organizes and reinstates delivery schedules for the FF 91 2.0 Futurist Alliance.

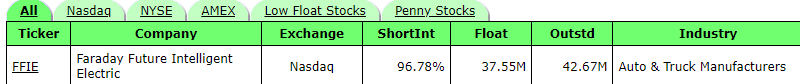

However, as market close, price action ended at $0.60 (+12.17%) for the day, while retail traders took the opportunity to shore-up the remainder of their trades, they were also posting their positions on social media. As such an overview of available call options detailed that almost all available strike prices are above $1.00, with a gamma of approximately 0.7, supporting my analysis that this stock could have positive price pressure momentum which could allow FFIE to break out as early as next week. Does this mean that FFIE is going to see $100? Probably not. However, there is a fair case to make for a quick, profitable, fun trade with a company that is on the fence, fighting to survive.

DISCLAIMER: The cauleneamagi substack, X, Discord, YouTube, and live streams are for educational and entertainment purposes only. I do not provide personal investment advice or stock recommendations. If you're seeking personalized advice, seek out your local finance professional who can review your personal situation, financial background, risk tolerance, etc. You should not treat any expressed opinion related to my content specific inducement to make a particular investment or execute a particular strategy. My opinions are my own, based upon information considered reliable, but I do not guarantee its completeness or accuracy. As such it should not be relied upon as completely accurate in all aspects as markets change frequently and violently. I will not update or correct any information provided after content is posted except through my sole discretion. Statements and opinions are subject to change without notice. I am not paid for the opinions I have, nor should my opinions be considered expressed endorsement of a product, service, commodity, or strategy. Past performance is not indicative of future results. Strategies or investments discussed may fluctuate in price or value. Therefore, investors may get back less than invested. Investments or strategies mentioned may not be suitable for you. This material does not consider your particular investment objectives, financial situation or necessities. This content is not intended as recommendations appropriate for you. You must make an independent decision regarding investments or strategies. Please do your own research. I strongly suggest readers and subscribers professional financial consulting services with any questions or concerns that may violate this disclaimer.

Is FFIE A Fair Trade in FY2024? Maybe.