Oil has been a sought-after commodity since the ancient Sumerians, Babylonians, and Assyrians, respectively who used it for light, lubrication, and more. Since then, oil has been industrialized because of WWI, leading to the phasing out of coal-powered steam ships to oil, marking oil a primary component for a powerful Navy. As a result, oil is now an integral part of finance and geopolitics. Riyadh’s decision-making regarding its oil reserves is a vital component to understanding development in the Middle East and across the globe. Since WWII, Saudi Arabia and the United States have enjoyed a mutually beneficial relationship. Today however, the Saudis may be shopping for other strategic partnerships in the wake of Ukraine, Gaza, sanctions, and geopolitical tension.

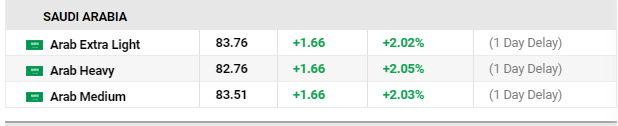

Iran, Iraq, Russia, Saudi Arabia, Canada, and the United States are all the greatest exporters of oil with Saudi-Arbia leading the pack with an 8% divergence between it and its next closest competitor. The continued partnership between the United States and Saudi Arabia is paramount for the U.S to maintain its access to Saudi Arabian oil fields. This uncomfortable dependency on Riyadh puts the United States in a vulnerable position given the Biden administrations hostility towards oil refinery construction since his inauguration. Saudi Arabia has exercised this leverage by officially allowing the expiration of the 1951 Mutual Defense Assistance Agreement on June 08, 2024. This has forced the United States to renegotiate the terms of the 70-year-old agreement wherein Saudi Arabia is working to implement a variety of changes to its oil exports, security, and strategic partnerships.

The decision comes amidst the war in Gaza; Ukraine under attack by Russians in the Far East, the Afghanistan evacuations, and China on the Asian continent shoring up its investments in its Central Bank Digital Currency (CBDC) project. These events have increasingly put the United States at a significant disadvantage in negotiations for oil exports and it doesn’t appear the negotiations are any further along though sources have recently noted that Washington D.C. and Riyadh are close to a decision, a narrative I do not subscribe to.

Firstly, Saudi Arabia has announced its official and complete participation in China’s CBDC project, “Project mBridge,” which is compatible with the Ethereum Virtual Machine. The news of this strategic decision by Saudi Arabia signals a new age for the Middle East, crypto, and the world. The Saudi Arabia seems to be taking advantage of this unique moment in human history by denying the United States the petrol dollar, renewing its relationship with Iran, and participating in Project mBridge. It appears the United States is no longer a strategic partner of the Middle East, and it was Saudi Arabia who decided.

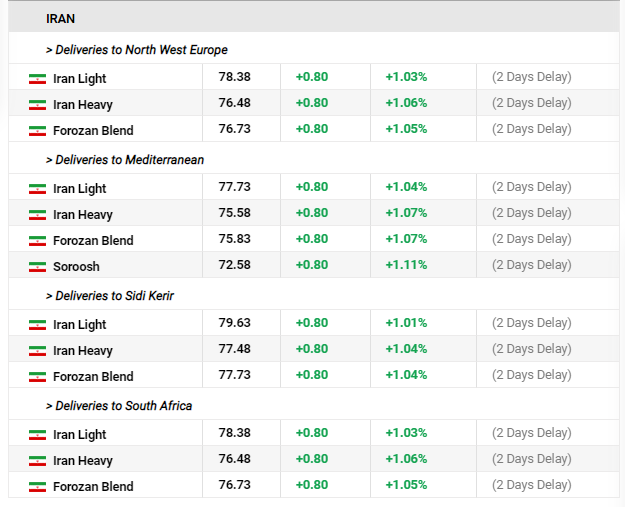

Now, the United States is working to renegotiate its mutual defense agreement, adding new features including nuclear provisions for Saudi Arabia. Given that the United States has a public position of nuclear non-proliferation, I am confused as to why we continue to offer it in negotiations. The Saudis are renewing diplomatic relations with Tehran a few years after the passage of the Joint Comprehensive Plan of Action (JCPOA) or the Iran Nuclear Deal, a relationship which appears to be going well. It has traditionally been a mainstay of the Saudi geopolitical narrative to preserve stability in the region, security, and prosperity. While in partnership with the United States, Saudi Arabia has only seen turmoil in the Gulf War, the invasion of Iraq, Afghanistan, ongoing terror operations in the region, regional conflicts in Syria, sanctions on Iraq, Iran, and Russia, it is likely clear to the Saudi’s that the United States has been a bulldozer in the Middle East. For the first time in 70 years, Riyadh has an opportunity to take control of its own region with its own strategies, partnerships, and alliances.

To combat this aspiration, dangerous alliances, and the safety of Israel, the United States has begun focusing its efforts on adding similar “civil nuclear agreement” provisions to its new mutual defense proposal under with Riyadh the condition that Israel and Saudi Arabia establish diplomatic ties and a path forward to establishing a Palestinian state. However, if the relationship between Tehran and Riyadh is strengthened by the continued involvement of the U.S., why Saudi Arabia would care to establish a civil nuclear agreement with the United States when Iran has the information already? I’m not a non-proliferation expert by any means, but it seems to me an obvious question that intelligence officials should be considering when interfacing in the newly titled “post-American Middle East.”

From this vantage point, as an intelligence researcher, military police vet, and analyst, the United States is not negotiating from a position of strength with Saudi Arabia as Iraq and China are emboldened to continue their respective paths of disruption across the Middle East. It is the recognition of these facts that could be the solution for the United States. The United States is in a position now where it must defeat CBDC if we have any hope at securing the region. If the United States has any sense, it will soon allow crude transactions to take place in Bitcoin, to incentivize the Riyadh. Interesting that shortly after all of this, the “Silk Road” wallet was “tested.” Just a thought. Hedge your bets now because that would be a great way for Bitcoin to hit $100K before the end of 2024.

Oil and Crypto in the post-American Middle East